retroactive capital gains tax history

Congress has been adopting retroactive tax increases for a very long time essentially since the 1930s. In some cases you add the 38 obamacare tax but at worst your total tax bill is 238.

Doing Business In The United States Federal Tax Issues Pwc

A The maximum tax rate includes effects of exclusions 1954-1986 alternative tax rates 1954-1986.

. In different words the 1031 exchange merely places off paying capital gains taxes till sellers hold onto the proceeds from a house sale. Explanation of the Constitution - from the Congressional Research Service. The 20 tax rate on capital gains can raise as high as 318 for some individuals.

Issue Date December 1988. 1991-1996 the minimum tax 1970. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced.

It nevertheless remains possible that we see even. This news is not surprising but it rather buries the lede. 7 rows Introduced 24 June 1997.

The corporate tax rate on long-term capital gains currently is the same as the tax rates applicable to a corporations ordinary income. The Administration leaked. The following state regulations pages link to this page.

Indeed we need not look back too far in history to find a prime example of retroactive tax increases. While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition rule that. Youll note that between 1970 and 1979 wealthy.

Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. Signed 2 January 2013. Signed 2 January 2013.

Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. What caught most everyone off guard is the. President joe biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive.

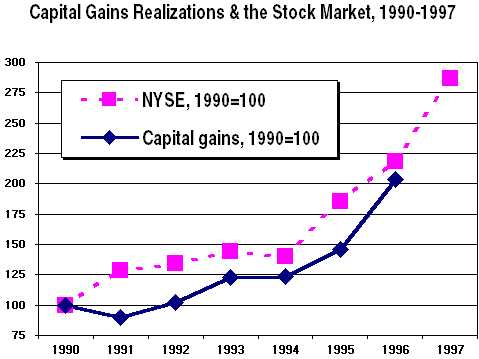

Signed 5 August 1997. Long-term gains excluded prior to 1987 are included in realized capital gains. Data for each year include some prior year returns.

This resulted in a 60 increase in the capital gains tax collected in 1986. Significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition rule that functionally split the single calendar year 2003 into two periods for purposes of computing the capital gains tax. Most states that do not tax income Alaska Florida Nevada South Dakota Texas and Wyoming do not tax capital gains either nor do two states New Hampshire and.

Reduced the maximum capital gains rate from 28 percent to 20 percent. The 1913 Revenue Act was the first one with an effective date before the date of the actual. More specifically in August of 1993 Congress passed the Omnibus Budget Reconciliation Act.

American Taxpayer Relief Act of 2012 Pub. Chart by author. Most states tax capital gains as ordinary income.

Includes short and long-term net positive gains. There is pressure for another wealth tax on individuals making 5 million or more who would see another 3 tax raise. Effective for taxable years beginning after 31 December 2012 ie for the full calendar year in which it was signed.

But many were taken off guard by the. President Biden really is a class warrior. The 1031 Exchange named after Section 1031 of the IRS tax code permits investors to place off paying capital gains taxes in the event that they reinvest the proceeds made from promoting a rental property into another funding.

Effective for taxable years beginning after 31 December 2012 ie. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from 20 to 396. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along with the lock-in effect and tax arbitrage possibilities associated with this deferral advantage.

Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. As you can see with the exception of pre-1941 and 2004-2012 maximum capital gains tax rates have regularly been 20 or higher. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

The new approach also taxes capital gains only upon. This resulted in a 60 increase in the capital. 112240 Introduced 24 July 2012.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains realized by taxpayers with income in excess of 1 million annually.

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Capital Gains Tax Past Present Future Don T Mess With Taxes

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Managing Tax Rate Uncertainty Russell Investments

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Historical Federal Tax Rates By Income Group My Money Blog

Notes On The Budget Surplus And Capital Gains Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Managing Tax Rate Uncertainty Russell Investments

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation

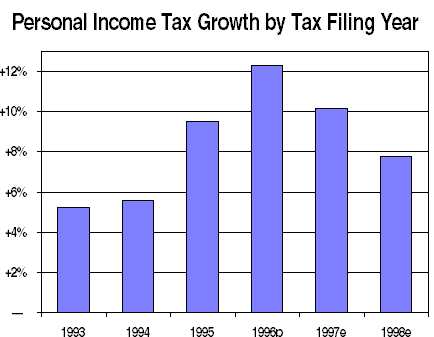

Notes On The Budget Surplus And Capital Gains Citizens For Tax Justice Working For A Fair And Sustainable Tax System